The Never Broke Again Wealth Guide

Straightforward Insights to Help You Learn About Money

No, I don't want your email address. I'm giving you this framework completely free, no strings attached. Just tips from someone who has been in the wealth management game since 2013.

**You Won't find these insights on social media—because REAL wealth-building isn’t about trends or viral hacks. It's built on time tested principles, not nosie and that's exactly what you'll get inside.

Is anyone else tired of Social Media Finfluencers dishing out the same cookie-cutter advice?

In 2020, as the world was shutting down, I made a bold decision:

I walked away from a $200,000-a-year career in finance to pursue something more meaningful.

I was tired of seeing the best financial advice kept behind closed doors—reserved only for the so-called "high net worth" crowd—while everyone else got served generic, one-size-fits-all solutions.

So I started building something different.

Day 1 of 369 Financial: A dream turned reality.

2020: Just me, in PJ bottoms, crafting investment strategies that set the foundation for 369 Financial. Humble beginnings, big goals.

Building my business wasn’t easy—and honestly, it shouldn’t be.

While the world chased viral trends and overnight success, I stayed focused on what actually matters:

Creating smart, personalized financial strategies for people who care about long-term growth.

Markets evolve. Strategies change. Noise gets louder.

But if you’re not growing with intention, you’re falling behind.

Everything started to shift in 2022.

The stock market was stumbling. People were panicking. Fear was everywhere.

But in times of chaos, clarity matters more than ever.

While others froze—or fled—I stayed focused on the long game.

I saw opportunity where others saw crisis.

And that mindset? It made all the difference.

In 2022, I was sketching out the concepts to share with the world. The finfluencer space has become very crowded... It’s been a journey, but great things take time—and I’m proud to finally share this with you!

9 stands for philanthropy—and I believe giving back is essential. Speaking to future finance leaders is one way I strive to inspire others to build wealth not just for themselves, but to make a difference in the world.

I’ve had the privilege of speaking to finance students —

sharing what it really takes to build wealth and launch an investment firm in today’s competitive landscape.

Competing with billion-dollar institutions isn't easy.

But with the right strategy, relentless focus, and a clear vision, success becomes more than possible—it becomes inevitable.

I don’t live in a mansion. I don’t drive an exotic car.

And honestly? That’s never been the goal.

What matters to me is helping people take control of their financial future—

to build lasting wealth and create a life that reflects their values.

Empowering others to grow, give, and thrive…

That’s the kind of success I care about.

It’s why I created this guide.

This is me, in the last week of 2024, working on 369 Financials' Annual Letter.

Debunking the Myths: Misleading Money Advice from Social Media Influencers

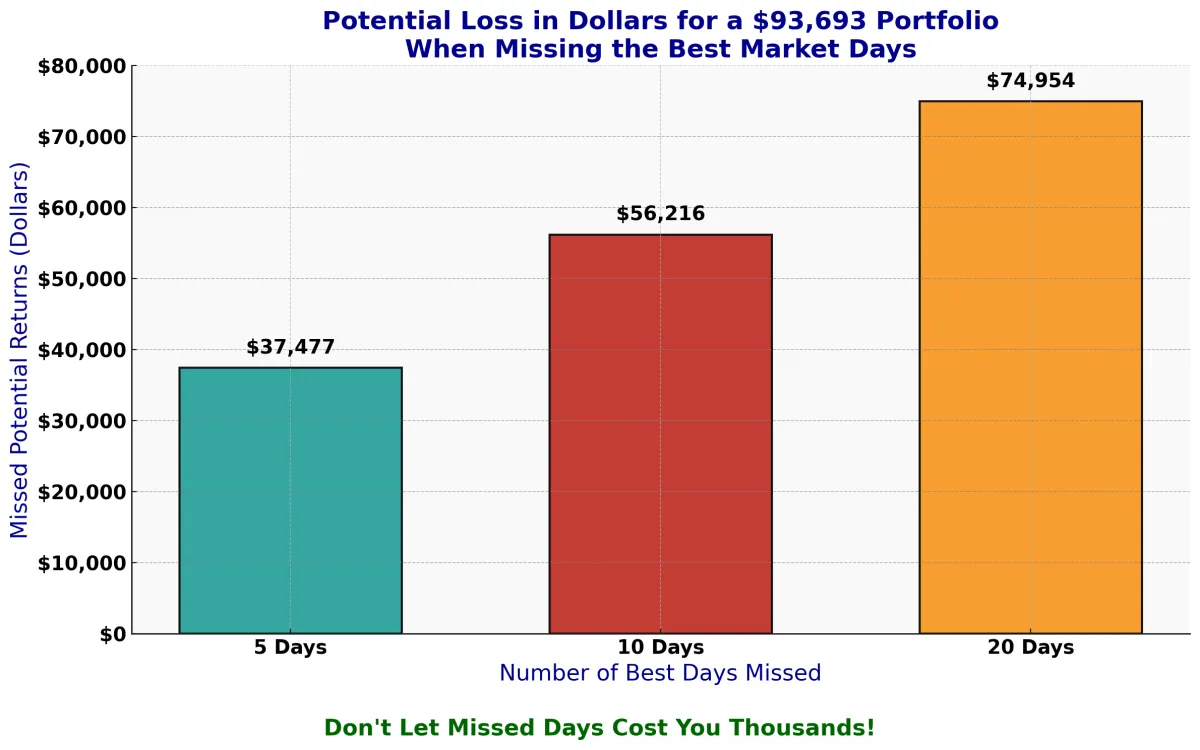

Money Myth #1: Day Trading is the Fast Track to Wealth

Think day trading is the key to riches? Think again. Here's a startling statistic from the last 20 years:

Miss the 5 best days in the market, and your returns could drop by 35-40%. Miss the 10 best days, and you're looking at a 50-60% decrease. Miss the 20 best days, and you've lost 80% of the market's potential returns.

Timing the market isn't just risky—it's nearly impossible. Instead, consistent, long-term investing is what builds real wealth.

*Source: J.P. Morgan Asset Management, “Guide to the Markets,” 2020.

Money Myth #2: Insurance is the Ultimate Wealth-Building Tool

For individuals with assets under $13.99 million (as of 2025), there are often smarter, more efficient ways to build and protect wealth than relying heavily on traditional insurance products.

While insurance can play a valuable role in a comprehensive financial plan, it shouldn't be your go-to solution for wealth-building.

Here's why:

1. High Fees and Mediocre Returns: These can significantly limit how much wealth you can grow over time.

2. Not an Investment Vehicle: Insurance is designed for protection, not growth, and should never be treated as an investment strategy.

Instead, focus on a balanced approach that includes diverse protective measures and sound investment strategies. This ensures you're maximizing your potential for growth without unnecessary limitations.

*Source: IRS Estate Tax Guidelines for 2025.

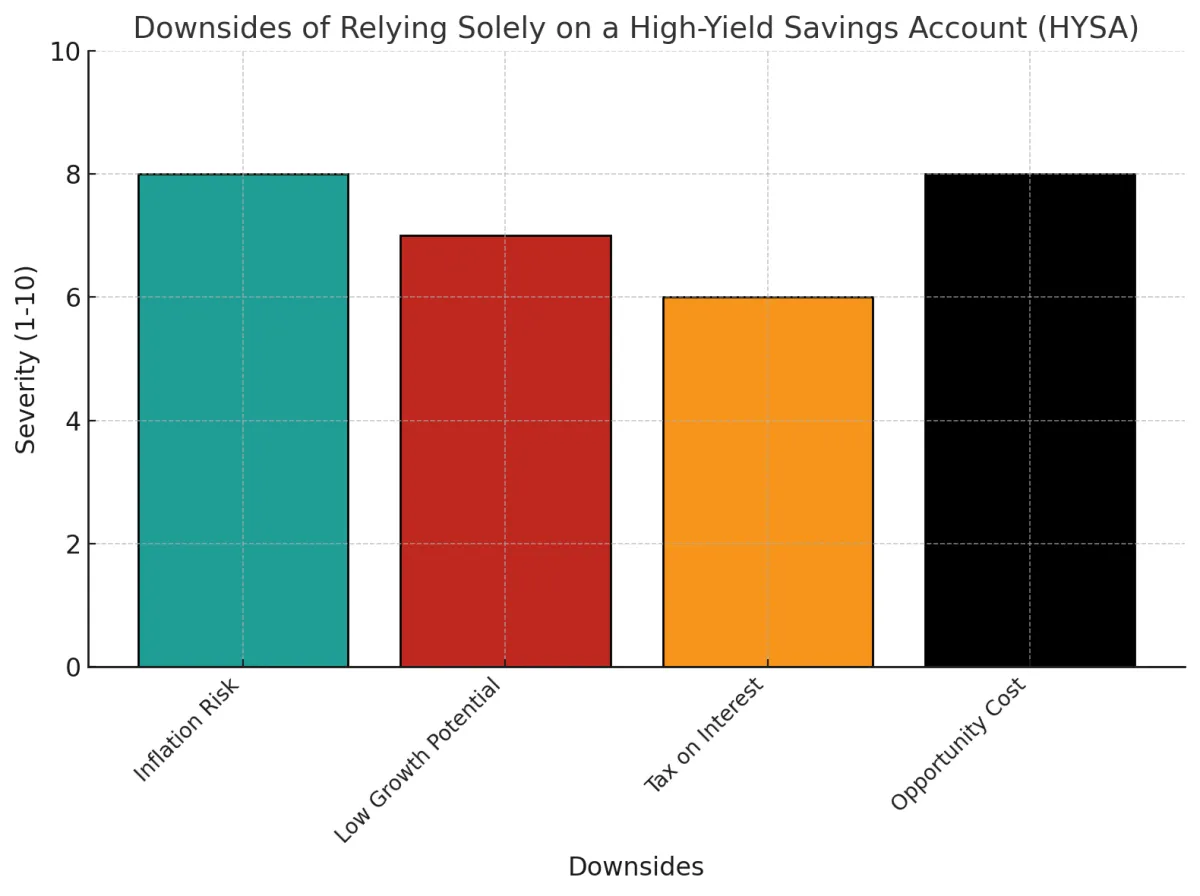

Money Myth #3: (HYSAs) Are the Best for Your Money

I see a lot of Social Media Influencers Say..."A high yield savings account is the answer to all of your problems!" Than they

(insert affiliate link here). Yes, a HYSA can help you make extra money, yet there are still problems to consider such as inflation risk, low growth potential when interest rates decrease, taxes on your interest, and the opportunity cost that you could possibly miss out on by not having your money in the proper investment strategy.

*Source: GoBankingRates, “The Downsides of High-Yield Savings Accounts,” 2023.

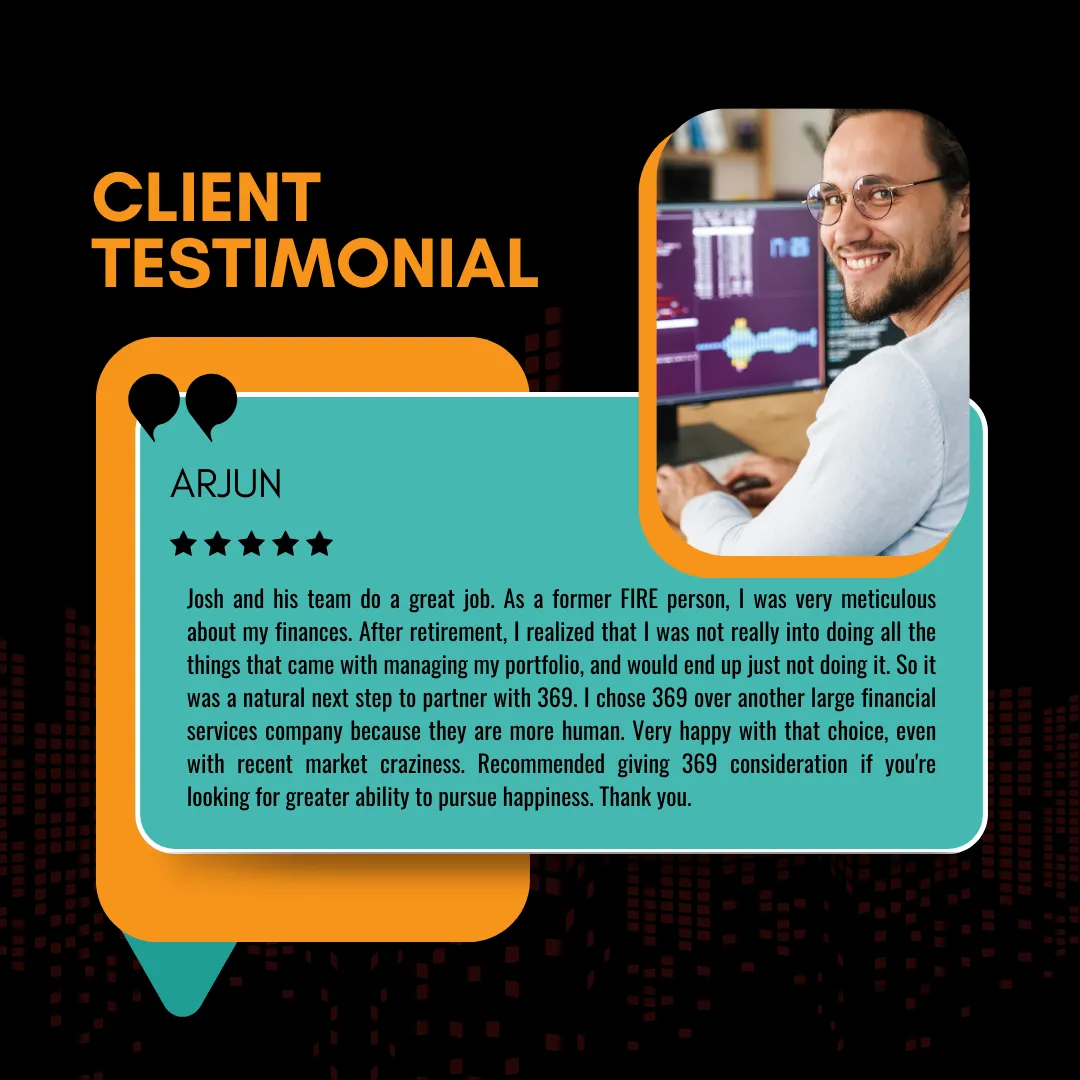

What Our Clients Are Saying: Real Experiences from People We've Helped

***Disclosure***

Unlike many "financial influencers" who are not subject to regulatory oversight, 369 Financial operates as a registered investment advisory firm and adheres to the marketing and testimonial rules established by the Securities and Exchange Commission (SEC). These rules are designed to promote transparency, integrity, and compliance in all client communications.

***About Testimonials***

The testimonials presented on this website reflect the individual experiences of select clients. They are not intended to represent the experiences of all clients and should not be interpreted as a guarantee of future performance or investment outcomes. To respect client privacy, we may use initials, anonymized details, or altered visuals in connection with these testimonials. No clients have been compensated in any way for their feedback or testimonials.

***Third-Party Reviews***

While the testimonials displayed on this website have been curated, additional reviews about our firm may be available on third-party platforms. We encourage you to search for “369 Financial” to access these independent reviews. Please note, however, that the testimonials featured on our website are separate from those found on third-party platforms and are presented here for informational purposes only.

Frequently Asked Questions

Who is Joshua Krafchick again?

Joshua Krafchick is an investment advisor with over $11 million in assets under management as of September 2025. He has provided financial guidance to clients across the United States. This statement does not constitute a guarantee of future performance, and individual client experiences may vary based on their unique financial situations and goals.

What’s actually included in the guide?

This guide includes 10 foundational principles that reflect the same investment philosophy I use when working with high-net-worth clients. It’s a clear, strategic framework built to help you think differently about investing—grounded in time-tested ideas, not trend-chasinng.

. Can a free guide really help me?

It can—if it’s built on substance. This guide isn’t about quick wins or hype. It’s an educational resource designed to sharpen your thinking and provide a long-term lens for evaluating investment decisions. It’s not advice, but it’s a strong place to start.

Is the information in the guide credible?

Yes. The insights are drawn from well-established investment principles used by professionals and legendary investors alike—combined with my own real-world experience. The goal is to help you think more clearly and make more informed decisions.

What's the catch? Are there hidden costs?

There’s no catch. No opt-in required. No upsell hiding at the end. The guide is 100% free—because I believe education and clarity should be accessible. If you find it helpful and want to go deeper, I offer ways to connect. If not, that’s okay too.

Why should I trust this guide over free content online?

Most free investing content is built to go viral—not to serve you. This guide was created with a different goal: to give you a grounded, strategic perspective. It’s not meant to replace professional advice, but it’s built from experience—not algorithms.

What exactly will I learn from this guide?

ou’ll learn how to:

Evaluate investments based on intrinsic value, not hype

Avoid common behavioral traps like fear, greed, and chasing trends

Understand how inflation, taxes, and market cycles affect real returns

Build a steady, long-term investment mindset grounded in principle

Navigate market noise with more confidence and less emotion

Who is this guide for?

This guide is ideal for professionals, entrepreneurs, and investors who want to be more intentional with their financial decisions. If you’re looking to grow your wealth with more clarity—and less chaos—it’s built for you.

369 Financial | Copyright ©2025 | All Rights Reserved

This site is not a part of the Facebook website or META Inc. It is not endorsed by Facebook in any way. “Facebook” is a trademark of META Inc.

This material is for informational and educational purposes only. It does not constitute investment advice or a recommendation. Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Individual financial situations vary. Please consult a licensed financial professional before making investment decisions.

Any case studies or examples referenced are for illustrative purposes only. No outcome is guaranteed.

Privacy Policy - Terms & Conditions

**At 369 Financial, LLC, we value transparency and customer satisfaction. Refund requests must be submitted within 30 calendar days of purchase. Email [email protected] with your full name, order number, and proof of purchase. Certain digital products or services may be non-refundable. Refunds are issued at the sole discretion of 369 Financial.

For unresolved concerns, we offer a complimentary 30-minute consultation. If no resolution is reached, you may be eligible for a full refund.

369 Financial LLC is a fiduciary financial advisory firm offering custom financial planning and investment management services. Investing in securities involves risk, including the possible loss of principal. Past performance does not guarantee future results. Investments in foreign securities may involve additional risks, such as currency fluctuations, geopolitical instability, and differing accounting standards.

Joshua Krafchick provides advisory services through 369 Financial LLC, a registered investment adviser. 369 Financial LLC is registered to offer investment advisory services in Arizona, Florida, and Maryland, and has filed a conditional notice in Texas pursuant to applicable regulatory requirements. Registration as an investment adviser does not imply a certain level of skill or training. Services are provided in accordance with relevant state laws.

Serving clients virtually across the United States, with regulatory registrations in Arizona, Florida, Maryland, and a conditional notice filed in Texas. We work primarily with professionals and families who prioritize values-driven planning growth minded, and philanthropic goals.

.

Past performance is not indicative of future results.